The pandemic may have caused a storm, but it has also created fertile ground for innovation.

The rise of AI, spearheaded by generative AI tools like ChatGPT and Stable Diffusion, has not only aided the tech sector’s recovery, but also propelled it into unprecedented growth. As we look to the future, one thing is clear: AI is not just a part of the technology industry; it will The tech industry.

In general, the markets are recovering after the pandemic. However, the advent of AI has been a particular boon for tech stocks, particularly hardware makers.

The most obvious recent example is of course NVIDIA, the company behind the leading industrial-grade graphics processing hardware and developer of the CUDA technology, without which modern AI developments would not be possible.

In just five months, NVIDIA saw its stock price rise the most in its history. It is now up 166% after suffering a 50% decline due to a crude combination of U.S.-China political infighting, the 2022 chip crisis, and a market stall caused by the COVID-19 pandemic. The company has rebounded from those losses in less than half a year, and there’s no sign of a near-term slowdown.

AI hardware makers are on fire

However, NVIDIA isn’t the only company benefiting from the AI wave. Other competing and related companies are also benefiting significantly from this new trend. Here are some of the winners.

Advanced Micro Devices Inc. (AMD)

AMD manufactures high-performance computing and graphics solutions used in AI applications. They have developed specific GPUs and CPUs optimized for machine learning and AI workloads, and they are the second most popular GPU choice for home users.

So far this year, the company’s shares are up 94% from $65 to their current price of $125. If the stock price hits $145, it would erase all the losses of the past year.

Taiwan Semiconductor Manufacturing (TSM)

TSM is the world’s largest independent (pure) semiconductor manufacturer. As a foundry, they produce chips for various companies, many of which are in the field of AI.

The company is up 39% year-to-date. A further increase of 20% would make up for the losses from 2022. chip crisis? Where?

Micron Technology (MU)

Micron Technology is a global leader in the semiconductor industry. They manufacture a wide range of memory and storage products that are critical components for AI and machine learning systems that require fast and efficient data processing.

MU stock is up 47% so far in 2023 and has potential to grow another 27% before meeting resistance marked by its own all-time high.

Three AI-related software stocks to keep an eye on

Beyond the hardware space, software companies are also having a spectacular year, particularly due to the explosion of generative AI, with ChatGPT leading the hype.

Meta (META)

Meta, formerly known as Facebook, is one of the favorites among investors. The shift in focus from the metaverse to AI yields results for Mark Zuckerberg’s company, which, in addition to implementing solutions into its traditional business model, has also published significant open source contributions, including the Large Language Model LLaMa.

A Large Language Model (or LLM) is an AI model trained on a large amount of text data and capable of generating human-like responses to various text prompts. (This simulates a natural language conversation.) LLaMA is a very popular LLM among AI users and developers.

Meta posted its best half-year performance in its history, up 116% so far in 2023.

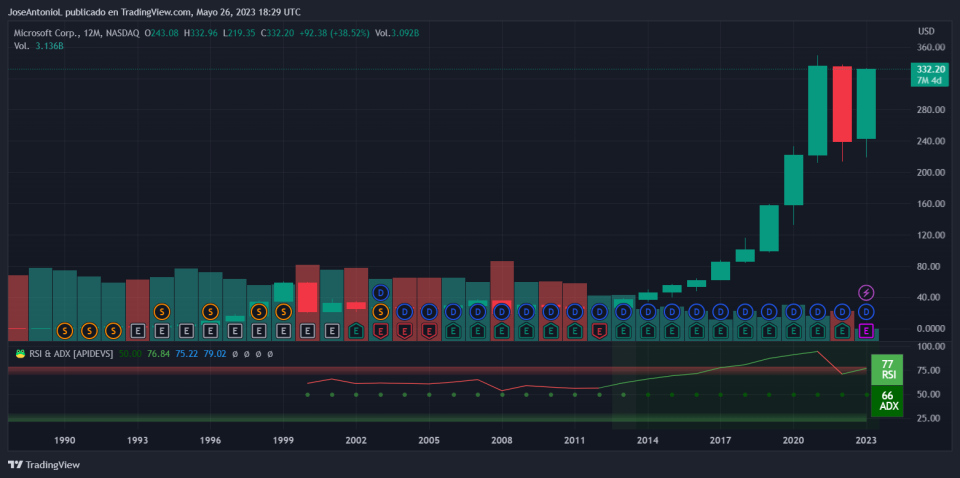

Microsoft (MSFT)

Bill Gates’ company is known as the developer of Windows and the Xbox game console. But now it’s on the rise to be the “godfather” of OpenAI, the company that developed LLM GPT-4 and ChatGPT, the chatbot that put AI in the media spotlight.

OpenAI is valued at $29 billion, with Microsoft alone investing $13 billion. The decision to integrate GPT-4 into the Edge browser and the Bing search engine, as well as to use Bing as the default search engine for ChatGPT, was a catalyst for the tech giant’s share price. So far in 2023, Microsoft is up almost 40%, erasing losses from the previous year.

Alphabet Inc (GOOGL)

Alphabet, Google’s parent company, is investing heavily in AI. They have developed tensor processing units (TPUs), which are purpose-built application-specific integrated circuits (ASICs) used to accelerate machine learning workloads. They are also developers of TensorFlow, an open source AI library, and offer cloud-based AI services. The company was significantly more active in the area of software.

The launch of Bard with its improved PaLM2 was a success and positioned it as a direct competitor to ChatGPT. The release of LLM models tailored to the needs of clients has generated a positive response from investors (contrary to what happened when the company introduced its first chatbot and it started hallucinating). GOOGL shares are up 40% so far this year and are 20% from growth before re-challenging resistance at their all-time highs.